The premise for this article is that the business has already been through the journey of identifying the customer problems, creating value through product innovation, communicating value via sales teams and value messaging on the website. Now the customer understands the value of your proposition, how do you monetise it and generate more revenue?

This article will focus on 2 core areas;

- Price segmentation

- Pricing strategy

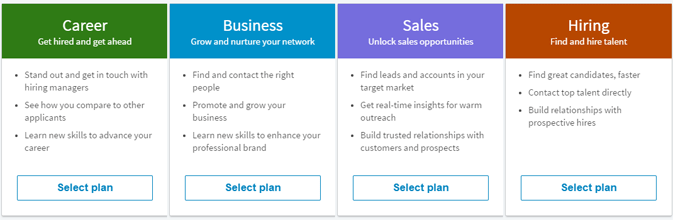

Price segmentation is the process of grouping customers based on specific attributes where their willingness to pay differs from other groups of customers. This often involves delivering more value to these customers which they are willing to pay a premium for, and therefore it is important to offer a more sophisticated range of products or services to cater for this. LinkedIn is a great example of this, and achieve this effectively as illustrated below;

The price of the subscription increases based on the value of features offered and the use case of the customer segment.

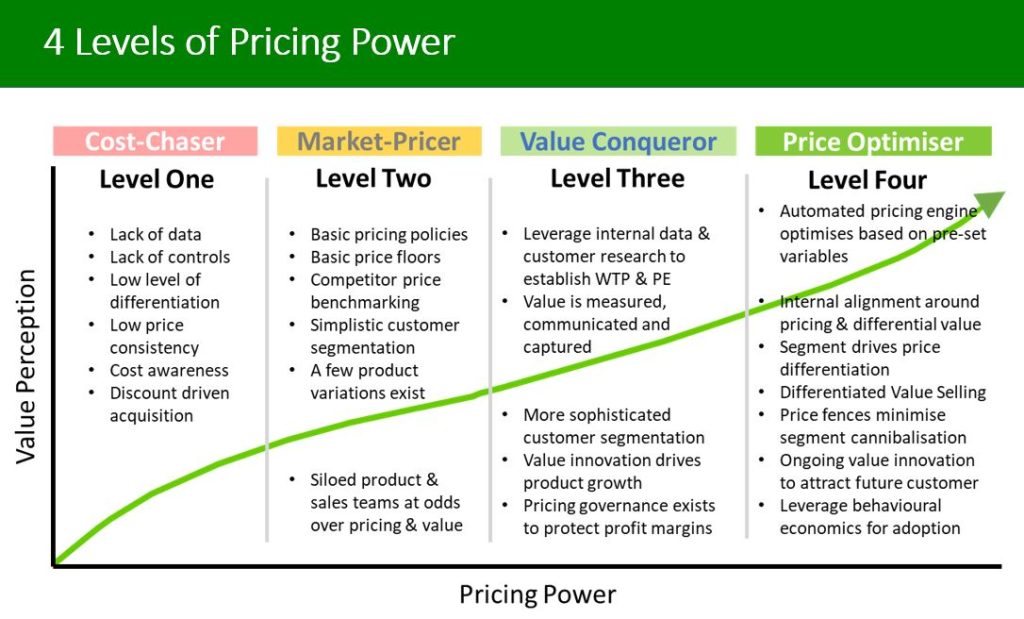

The level of pricing power that an organisation is able to realise can be identified on a maturity such as the one below, beginning with cost-plus pricing in the least mature state, followed by market-based pricing, customer segment differentiated pricing, and with value-based pricing ultimately leading to optimised product or service pricing at the highest level of pricing maturity. These principles can be applied to any industry where companies offer differentiated value propositions, and customer segments can be clearly defined.

As maturity increases, setting the price points becomes more complex and typically involves a good deal of research, analysis and experimentation. A value-based pricing approach is more resource and data intensive but will unlock far greater revenue growth potential than solely cost-plus or market-based pricing. It is highly unlikely that a business will land on its optimal price point on the first, second or even third attempt. This is an iterative process that needs to be reviewed regularly as value perception changes, competitors vary their price points or value proposition, and when new competitors enter the market.

Customers will always tell you when you are too expensive but rarely if you are too cheap. Even when they tell you that you are too expensive, it does not necessarily mean that they will stop buying from you. The best way to test willingness to pay is to just increase prices and measure the revenue impact over a reasonable period of time. Businesses can mitigate some of the risk by gradually introducing these increases to subsets of the customer base, but it is important not to roll back a price increase based on an initial adverse reaction. Customers may take a little time to adjust to the new normal, and communicating product enhancements, additional value that differentiates your proposition, ahead of any price increase often minimises any backlash. Often competitors are also waiting in the wings for an opportunity to increase their prices and will likely take their cue from you.

If you are interested in learning more around price segmentation, value-based pricing strategy, and how businesses can leverage these to improve profit margins, then drop me a LinkedIn message and we can set up a time to chat further.