Does any of the following apply to your business?

One of the biggest misconceptions in business and around pricing that I have seen in my career is that when businesses are losing customers, they are quick to assume “our customers are not buying from us because we are too expensive”, rather than “customers don’t understand our unique value”. Pricing quickly becomes a contentious issue when value is unproven.

If your business is experiencing any of the issues listed above, then this article will enable you to determine where you sit on the Pricing PowerTM curve so that you can take action to reduce the amount of forgone revenue being left on the table. This will give you the confidence to increase your prices, knowing that it is supported by unique value that your competitors do not provide, and will therefore be tolerated by customers.

The key to surviving inflation and creating sustainable cashflow growth is Pricing PowerTM!

In the famous words of Warren Buffett;

“If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before you raise the price by a tenth of a cent, then you’ve got a terrible business. I’ve been in both, and I know the difference.”

Competitive advantage and value innovation is critical for sustainable growth because, without this, companies only compete on price which becomes a race to the bottom. For more on this, please refer to my previous article on “Find Your Competitive Advantage With Blue Ocean Strategy“.

Pricing strategy is all about monetising value and competitive advantage. Your pricing strategy must reflect the desired strategic positioning of your brand and proposition in the market.

Pricing is the engine or mechanism that drives your revenue, profit, and cashflow outcomes. Just as using a 4-cylinder engine will not win you any formula one races, your business needs a V8, or even better, a V12 pricing strategy to win the competitive race for your ideal customers. But before you can build a good pricing strategy, you need to revisit the core reason that your customers buy from you in the first place, which is the PERCEIVED VALUE of your product or service.

Improving perceived value comes about by first identifying what customers value the most, and then framing your proposition in a way that clearly articulates value in the context of solving their problem. This varies depending on the customer segment that you are targeting, which highlights the importance of understanding your customers and why they need your product or service. In companies that operate in the B2B space, sales teams play a huge part in improving this perceived value, as opposed to B2C where perceived value is generated via your website, marketing and advertising campaigns, and of course, purchases from happy customers who hopefully go on to become raving fans!

Apple is a classic example of a company that invests significantly in understanding what their current and future customers will value the most, ensuring that their unique technology differentiates their products from that of their competitors. Their premium price tag helps maintain the perceived quality and exclusivity of their products. Apple’s brand loyalty and perceived superior product quality provides them with this Pricing PowerTM and sets up an artificial barrier to entry for their competitors.

The Netflix vs Blockbuster saga in the early 2000’s is another great example of how disruptive technology provided Netflix with competitive advantage, whilst Blockbuster failed to pivot their strategy fast enough to prevent them losing market share. Netflix combined this with innovative monthly subscription pricing for unlimited, ad-free streaming which customers took to and enabled them to scale their market cap by over $150 billion over the 20-year period, whilst Blockbuster ended up filing for bankruptcy in 2010. Netflix have raised their prices six times in the last seven years with another price increase on its way this year, yet Netflix maintains the lowest monthly churn rate in the industry at only 2.4%.

Wouldn’t it be incredible if your business had this sort of Pricing PowerTM?

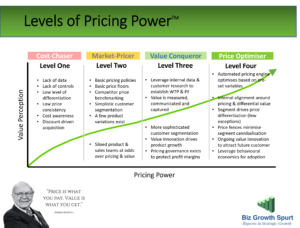

In the market, I see four levels of Pricing PowerTM based on a company’s ability to identify, create, measure, communicate value to their customers, and then capture / monetise value from their customers.

70 – 80% of businesses struggle to progress beyond the first 2 levels without expert help, with less than 5% achieving Price Optimiser status. Companies can learn so much about their Pricing PowerTM by leveraging historical sales data, competitor analysis, conducting price experiments, and choices analysis such as conjoint. The key to success is in the interpretation of the data points, and the creation and implementation of subsequent actionable strategies. The few businesses that can both conquer value and optimise price are able to sustain a healthy growth in market share, profit margins, and cashflow whilst benefiting from happy customers, employees, executives, and shareholders by continuously innovating and monetising value.

Which level of Pricing PowerTM is your business at? Please share in the comments below

2 thoughts on “Improving Pricing Power Is The Pathway To Profitable Growth”

Nice post!

Good article!