Which conjoint or “trade off” analysis is appropriate for building your pricing strategy?

Well, it depends on your objective. The 2 most common methods are Van Westerndorp (VW) and Gabor Granger (GG).

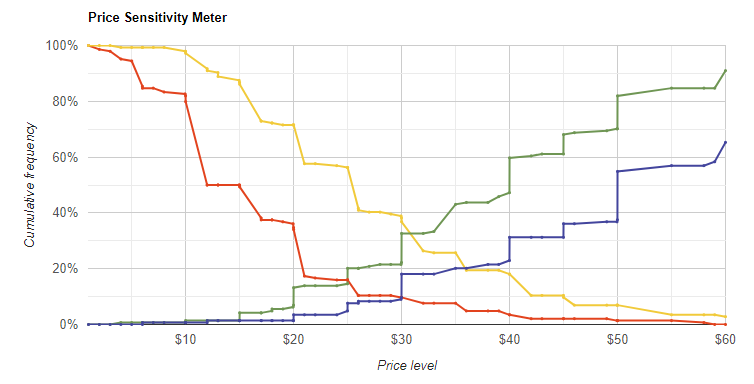

VW helps you to understand the acceptable price range through asking a series of questions to assess the respondents’ attitudes towards various levels of price. The study is designed to enable you to gauge price points that are “too cheap” vs “cheap” vs “expensive” vs “too expensive”. These responses then enable you to plot a Price Sensitivity Meter (PSM), lines for each of the above which intersect to provide you with the acceptable price range. The obvious flaw in this is that the questions are more open ended, not requiring respondents to make specific trade offs between product features and price points. Results can often be skewed with more respondents opting for “too expensive” rather than “too cheap”.

Example:

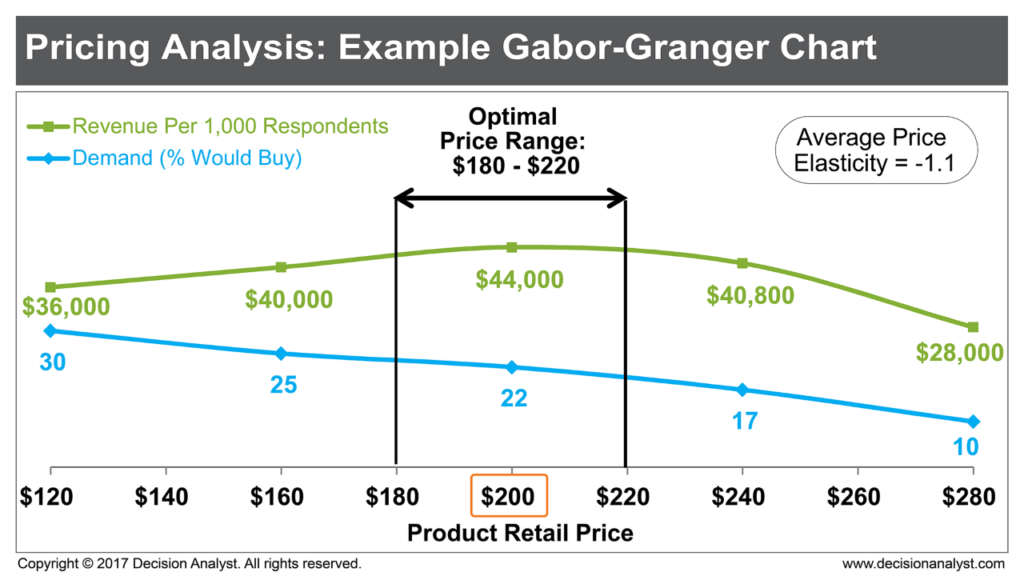

Conversely, the aim of GG is to find the maximum price that each respondent is willing to pay, therefore projecting price elasticity and the revenue maximising price point. I believe this technique to be a more precise way to measure willingness to pay as you are asking respondents to determine whether they would purchase a product at a specific price. Each subsequent question is an adaptation based on the previous response allowing you to map out the price elasticity curve.

Example:

Source: https://www.decisionanalyst.com/blog/pricingblog/

So, in this example, $200 is the revenue maximising price point. This methodology often works well once you have already established your product strategy and what your value proposition would look like, and have made some estimation of an acceptable retail price range (perhaps using VW).

Ultimately, any conjoint (trade-off) analysis or choice modelling survey using a realistic competitive set, provides an effective way for you to understand buyer preferences and willingness to pay. This can assist with optimising price, refining your product strategy in regards to prioritisation based on value, and enable you to build an effective bundling strategy. On the flip side, it can be a time consuming and expensive process, and you need to be confident in your understanding of customer value creation for each product feature before considering this approach (since it needs to be clearly articulated to respondents in the survey process).

Please feel free to reach out to me if you are looking for some pricing expertise from an experienced commercial leader who has successfully built and implemented new pricing strategies for many businesses across NZ and Australia. For a limited time, I am offering a complimentary consultation and value assessment (up to an hour).