Let’s take a look at the importance of customer segmentation in building any successful pricing strategy;

The main objective of any successful pricing strategy should be to get as close as possible to charging customers the maximum amount that they are willing to pay. Typically, willingness to pay is a function of the value derived from your product or service relative to what your competitors are charging. So, to give a simple example, I might be willing to pay $20 for a nice cocktail in a fancy bar (pub A) with live music, great ambience, and where customer service is gold star, i.e. bartenders make bespoke cocktails for you following a customer conversation about what you like. However, pub B across the road serves standard cocktails for $12 on happy hour but staff are more focused on volume of drinks served than customer service, the floors are sticky, and the music blaring from speakers is too loud to have a conversation. Pub A may be more appealing to office workers, guys hoping to impress their dates, a great venue for business networking events, etc. Pub B will still attract customers that belong to specific market segments such as students and other patrons with low affordability. The two offerings are fairly distinct and akin to perhaps eating at KFC or McDonalds versus a fine dining experience.

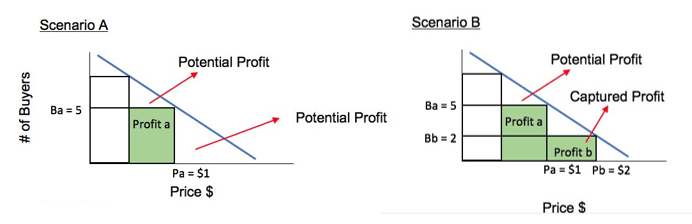

Now to segments and why this is important. Let’s take a simple scenario; imagine I only sell one product to every customer at the same price;

Scenario 1: For some percentage of customers, I am charging them less than they are willing to pay thereby leaving money on the table (happy customer but lost revenue opportunity). Due to the effect of anchoring, which is where customers expect to pay a specific reference price for a product or service based on past experiences or research, over time, these customers’ willingness to pay will also reduce making it more difficult to raise prices in the future. Another potential risk is that your customers may perceive the product or service to be of inferior quality since the price is lower than they were expecting to pay (the concept of “you get what you pay for”).

Scenario 2: For some percentage of customers, I am charging more than they are willing to pay. These customers will likely not purchase and will choose to go with a competitor therefore a lost acquisition opportunity.

Scenario 3: I might get lucky with a few customers and price matches what they are willing to pay

Price segmentation or discrimination (a less favourable term for it) is where a business charges different prices to groups of customers buying the same product or service based on their willingness to pay. Generally, the more price segments that can be identified, the more profit is captured (assuming costs remain constant). See illustration below;

Airlines are able to achieve this effectively by applying segmentation criteria such as time sensitivity, flexibility, trip duration, and distribution channel. Broadly speaking, they use fare rules to distinguish between leisure and business customers, charging higher fares to the latter group on the basis that they are typically less price sensitive as travel is less discretionary. However, applying the same principle to many other industries can attract a backlash from customers who deem it unfair to change reference prices for the same product to generate more profit.

Price fences are product rules put in place to discourage segment creep between price segments (arbitrage) to achieve a lower price. Examples of such mechanisms include geographic fences such as using postcode, and requiring customers to prove they belong to a specific segment to avail of a specific product or price (e.g. student ID, healthcare workers, seniors). Larger customers typically have more bargaining power therefore often expect to pay less. Volume-price tiering can be an effective price fence for this segment.

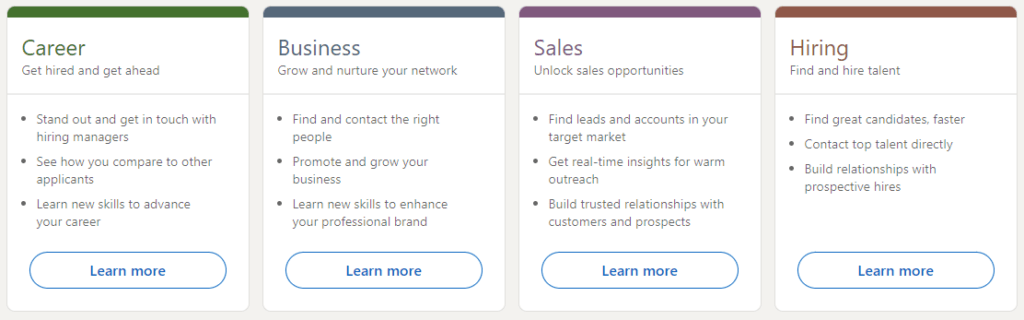

Another effective way to achieve this is by varying the amount of value offered at each price point, which relies upon customers to self-segment based on their needs and choice of product variation. There is some risk that some price sensitive customers may switch to an inferior product variation forfeiting value, but this is minimised by its relevance to the target segment. A great example of this is LinkedIn’s latest product offering;

Each feature bundle is customised to the needs of its target segment and priced uniquely based on the value of that solution. This achieves a tailored approach to product development, enables better targeting and sales conversion, as well as maximising revenue since monetisation of features aligns with providing customer solutions and willingness to pay. On clicking ‘Learn more’, customers are able to view a more detailed set of features, price points, and quantified value messaging e.g. “Premium Business members get an average of 6X more profile views”

Please feel free to check out my podcast interview with Mark Stiving to learn more about segmentation and how I have applied these principles to revenue optimise in businesses across the UK, Australia and New Zealand.